|

DISRUPTIVE INNOVATION |

|

|

The recent wild roller coaster ride for Gamestop Corp. stock has made payment for retail order flow a hot topic. Missing from this conversation is the potential for a disruptive innovation to the benefit of both big retail orders and institutional orders. For retail investors with big orders to fill there is a huge cost in terms of the time required in using their brokerage firm’s online trading platform and continually trying to camouflage what they are trying to accomplish; especially important for thinly traded stocks. Otherwise, market participants engage in front running which technically is not illegal since they don’t know with certainty the exact size of the big retail orders. Ideally, a new trading platform would allow big retail orders to connect with institutional orders and trade close to the midpoint of the bid-ask spread—a better price versus the status quo. Importantly, the time to complete the big retail order would be measured in seconds, not days. Of course, this would exclude payment for order flow although commissions could be charged due to the value delivered to customers. Note that existing SEC regulations fit the bid-ask market structure and ensure a “best price” for a tiny order that is meaningless to big retail investors. I have been issued patents for cool ideas for a Liquidity Builder platform to facilitate this process; e.g., limit orders based not on time priority but on the size of the order. Click here for details. After years of meetings with top industry people, two conclusions: (1) this would actually work to the benefit of investors and (2) good luck in trying to commercialize an innovation that requires the participation of industry members whose business would be disrupted. |

|

LIQUIDITY BUILDER OVERVIEW |

|

The problem is straightforward.

Solution

Strategic Benefit and Implementation A proven way to create substantial value in the New Economy is to successfully expand a trading platform business in which higher value is delivered to customers as the customer base expands. For example, MarketAxess Holdings developed a particularly successful trading platform for fixed income securities and will generate revenues in 2020 of about $660 million, yet the firm’s market value exceeds $20 billion due to its extraordinary profitability and competitive advantage. The ideal implementation of the Liquidity Builder would involve a large brokerage firm with a large client base of investors with a need to efficiently trade larger orders. The Liquidity Builder platform would provide more liquidity and higher value to participants as more institutional investors and retail clients participated. A sensible approach is to begin by focusing solely on institutional trading via the Liquidity Builder platform. This approach would expedite building a business without the added complications of dealing with large retail orders, which involve a time delay due to securing SEC approval. A successful startup of the Liquidity Builder with institutional participants could be followed at a later date by expanding to include large retail orders. |

|

SS&P PLATFORM |

|

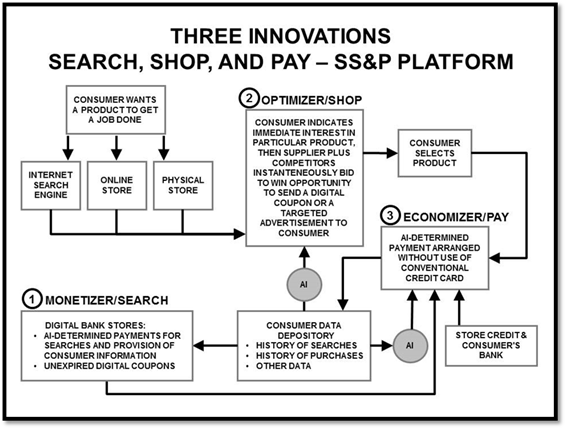

I have received approval from the Patent Office for patents involving three innovative ways (MONETIZER, OPTIMIZER, and ECONOMIZER) to use AI as part of a system to improve a consumer’s experiences in Search, Shop, and Pay. SS&P is unique in that three major innovations constitute a mutually reinforcing system to the ultimate benefit of consumers. (1) MONETIZER Consumers benefit from a digital bank that stores purchasing units earned from past searches, past purchases, and provision of personal information (verified data such as ownership of cars and real estate plus non-verified data). In addition, the digital bank stores unexpired dynamic digital coupons, i.e., dynamic in the sense of variable coupon terms and variable expiration dates generated by real-time AI analyses. (2) OPTIMIZER The fast-growing GetUpside app, https://www.youtube.com/watch?v=k38Og4vzzGk&t=187s, enables business operators to compete for the opportunity to send digital coupons to consumers for immediate use at gas stations and other local businesses. This is clear proof of concept that the Optimizer patents offer a practical means to build a platform business. In addition, this platform can be expanded to attract online consumers ready to purchase a wide variety of products or services. In addition, the Optimizer’s claims cover hardware and software that offer advantages (including lower costs) to retail stores seeking to eliminate checkout lines. The Optimizer approach is a low-cost way for large stores like Walmart to scale the patented technology. These economic advantages compare favorably to the recently introduced Amazon’s GO concept that uses expensive cameras and software for small stores. At checkout, customers review the potential savings from the use of store credit and bank withdrawal if a purchase exceeds their credit limit. Customers then choose Economizer price or credit card price. Customers receive periodic updates that communicate the AI-determined future credit limits corresponding to different levels of future purchases. |

The following figure illustrates how these three innovations are mutually reinforcing. |

|

In conclusion, in addition to earning a share of the payment market, a major objective of the SS&P Platform is to gain share of the digital advertisement market which amounts to approximately $330 billion in 2019. A firm that implemented the SS&P Platform and earned a 2% share of the digital ad spend would achieve revenues of $6.6 billion. |

|